The Roadmap to Decarbonisation - Liner Fuel Choices Remain Under The Spotlight

Topics: Insights

Terminal velocity? The decline of U.S. coal mining

Topics: Insights

Bunkers - if you wait long enough, everything becomes cool again

Topics: Insights

India's Credit Squeeze

At the start of 2020, few in India thought they would be looking back longingly to the quarter-ended September 2019, when India’s quarterly GDP growth dropped to 4.5% (a six-year low) and experts bemoaned weak manufacturing, falling consumer demand and private investment, and rising unemployment. Then again, these are distinctly unusual times.

Topics: Insights

COVID-19: Working from home in shipping

Shipping is a people business. Isn’t it? So, lock down should have been a disaster. So many parts of so many industries have been tested in the recent months of lock down, and shipping does feel that it has had its standard operating models tested considerably, but not necessarily in the ways one might have expected.

Topics: Insights

Has OPEC+ reduced oil market risks?

Ask any free-market economist’s opinion of cartelisation, and you are likely to receive a frosty and disapproving answer. Cartels exist, so the theory goes, to protect the interests of powerful producers of a commodity, at the expense and detriment of lowly and embattled consumers. It’s a well-known argument, which rests upon assumptions that a cartel manipulates supply in order to support prices for its members, and carves up the market so that end-users are deprived of choice. In short, cartels are bad, bad, bad.

Topics: Insights

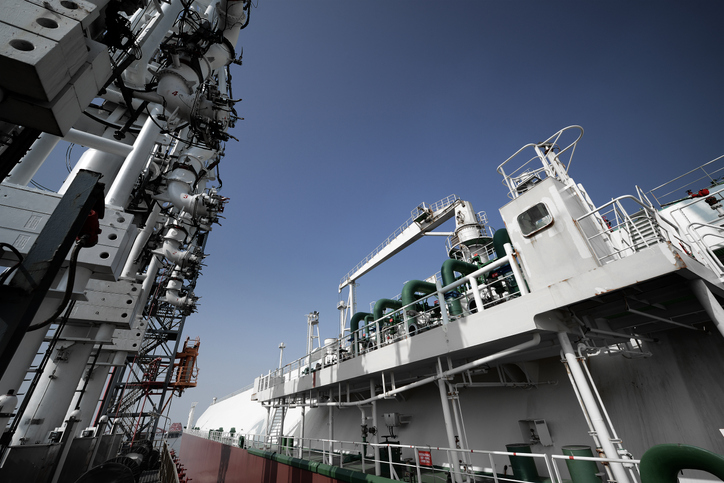

LNG - Navigating Politics and Pandemic

The emergence of the United States (US) as a net exporter of LNG in 2016 upended the supply-demand balance in the sector, enabling importers to accelerate a transition away from fuels perceived to be more polluting, and the LNG shipping sector to adopt a more spot-driven model, underpinned by speculative orders for LNG tonnage. In 2019, final investment decisions were taken to proceed with a reported 71m tonnes of new production capacity, much of this capacity also uncontracted, with further liquefaction projects, with a capacity of circa 900m tonnes per year, on the table by the beginning of 2020.

Topics: Insights

False Positives - Not at all Positive

The use of sanctions by the US Government, particularly under the current administration, has proved an immense compliance headache for our sector, with shipping, commodity trading, banking and insurance sectors all having to react quickly to initiatives put in place with little warning. While some industry participants proved somewhat adept at “working around” such issues, the increased surveillance of sanctioned and non-compliant activities, particularly over the last 12 months, has reignited a focus on compliance.

Topics: Insights

Tonnage provider risks in the container sector

A return to the bad old days beckons for container tonnage providers. With container volumes dropping like a stone since February 2020, demand for chartered tonnage has also fallen away – tonnage providers are looking at a bleak near-term future with no immediate kickers to push earnings back up.

Topics: Insights

A Post-Covid Future?

We are probably all considering the reality of our lockdown lives now that the novelty has worn off and, for those of us in COVID hot spots like the UK, we face up to ‘the new normal’, whatever that may be.

Topics: Insights

.jpg)