Infospectrum answers your FAQs

Infospectrum Analyst Team

Recent Posts

Get To Know Infospectrum

Two Minutes with Daniel Woodrow, Senior Analyst, Infospectrum - Oxford

This month we spoke to Daniel Woodrow, a Senior Analyst at Infospectrum’s Oxford office. He shares with us his take on working at Infospectrum, and the challenges faced by the shipping industry at the moment.

Topics: Two Minutes With

Terminal velocity? The decline of U.S. coal mining

Topics: Insights

Bunkers - if you wait long enough, everything becomes cool again

Topics: Insights

Two Minutes With Eleonora D'Orio, Senior Analyst

This month we spoke to Eleonora D’Orio, Senior Business Analyst at Infospectrum’s London office. She shared what it is like working in shipping along with how the industry has evolved since her career began.

Topics: Two Minutes With

Getting Serious About Sanctions - Introducing Infospectrum's New Sanctions Screening System "Sirius"

Sanctions, sanctions, sanctions! For those of us involved in risk and compliance, the seemingly never-ending increase in complexity around maintaining sanctions compliance can feel somewhat overwhelming at times.

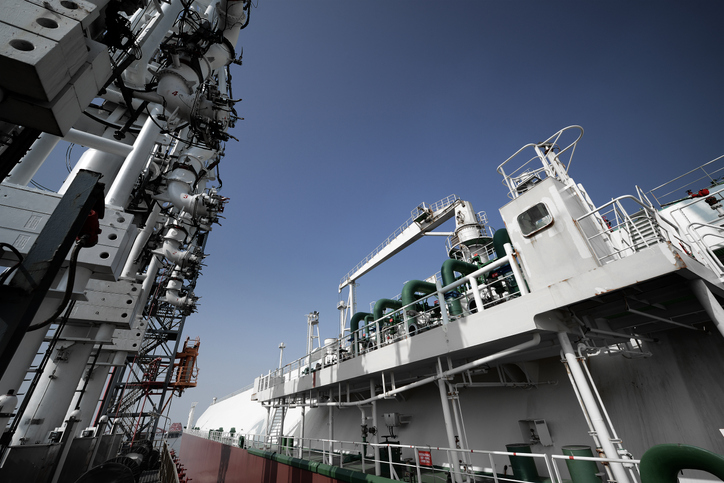

LNG exporters and the COVID-19 dilemma

After battening down the hatches in August, US LNG exporters have weathered the storm of Hurricane Laura, with the key Sabine Pass and Cameron LNG terminals now back in action. But, the other storm faced by the LNG industry, that caused by COVID-19, is set to rage on. Back in February, with US LNG cargoes cancelled or force majeure invoked by European and Asian importers, risk analysts may have feared that LNG exporters were genuinely facing an existential crisis.

LNG - Navigating Politics and Pandemic

The emergence of the United States (US) as a net exporter of LNG in 2016 upended the supply-demand balance in the sector, enabling importers to accelerate a transition away from fuels perceived to be more polluting, and the LNG shipping sector to adopt a more spot-driven model, underpinned by speculative orders for LNG tonnage. In 2019, final investment decisions were taken to proceed with a reported 71m tonnes of new production capacity, much of this capacity also uncontracted, with further liquefaction projects, with a capacity of circa 900m tonnes per year, on the table by the beginning of 2020.

Topics: Insights

False Positives - Not at all Positive

The use of sanctions by the US Government, particularly under the current administration, has proved an immense compliance headache for our sector, with shipping, commodity trading, banking and insurance sectors all having to react quickly to initiatives put in place with little warning. While some industry participants proved somewhat adept at “working around” such issues, the increased surveillance of sanctioned and non-compliant activities, particularly over the last 12 months, has reignited a focus on compliance.

Topics: Insights

Tonnage provider risks in the container sector

A return to the bad old days beckons for container tonnage providers. With container volumes dropping like a stone since February 2020, demand for chartered tonnage has also fallen away – tonnage providers are looking at a bleak near-term future with no immediate kickers to push earnings back up.

Topics: Insights