A return to the bad old days beckons for container tonnage providers. With container volumes dropping like a stone since February 2020, demand for chartered tonnage has also fallen away – tonnage providers are looking at a bleak near-term future with no immediate kickers to push earnings back up.

The immediate focus of the impact of the COVID-19 pandemic has, as usual, been on the core East-West container trades and the largest liner operators. While the container sector has never had a great record for profitability (and we need only remind ourselves of the collapse of the South Korean liner business Hanjin Shipping Co., Ltd in August 2016), liner operators have been surprisingly resilient since the onset of the pandemic. Tight and efficient capacity management has held liner company rates and revenues at comparatively steady levels during the first half of 2020, but the same cannot be said for many of the independent tonnage providers, who are now experiencing the knock-on effects of the collapse in container demand.

According to Container Trade Statistics, global container volumes have fallen by an estimated 8% year-on-year during the first four months of 2020, and by 16.9% year-on-year just for April 2020. Expectations for the rest of 2Q 2020 are equally depressing. A key insight into ongoing vessel demand is provided by the level of the idle fleet. While comparisons between the current situation and the global economic crisis in 2009 are bandied about, they do not give the true picture. Some 11% of the global fleet was estimated to have been idled in 2009 (around 1.4m TEU of containership capacity), but the latest estimates from Alphaliner put this figure at about 2.7m TEU or 11.6% of the global fleet as of the end of May 2020. An additional caveat here is that a sizeable portion of the current fleet is “idled” or non-operational as a result of scrubber retrofitting at shipyards in China and Turkey.

Day rates trending towards OPEX

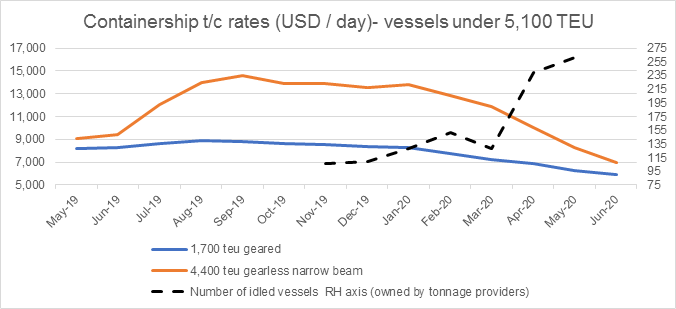

The impact on the vessel charter market has been clear – it took a little time for lower demand for vessels to filter into the market, but since April 2020, the decline in rates for all vessel sizes in the liquidity-providing sub-5,100 TEU charter market has been widely evident. Vessels in the 1,000 TEU and 1,700 TEU geared ranges (which are the workhorses for intra-European and intra-Asian feeder trades), have experienced 13% and 25% declines in daily hire rates in the period from 1 January 2020 to mid-June. But the bad news for tonnage providers does not stop there. Demand for these vessels is weak, but charterers genuinely have the upper hand, and are fixing ships for periods of 2-6 months and 3-12 months, meaning they have the flexibility to deliver when they want (and when the market is right for them), which adds to increased uncertainty over future revenue for owners. The more worrying aspect is that earnings are now coming much closer to estimated daily OPEX levels, leaving owners with a potentially stark choice – continue to operate at a loss, idle the asset or sell and retain remaining residual value (if any).

The European feeder market has been particularly impacted by the 30% capacity cuts in the Asia to Europe trade lane. The Denmark-headquartered Unifeeder A/S, which operates one of the largest feeder networks in Europe, has stated in press articles that the company has reduced operational capacity by 20% in recent months; our market sources have indicated that general demand remains weak, with any new fixtures often only for a few weeks, with liner operators having no real idea of even short-term market volumes.

The market for old Panamaxes of around 4,400 TEU has been relatively firm over the last 12 months as many of these units (which were deemed to be redundant after the opening of the widened Panama Canal in 2016), have found new employment in secondary East-West trade lanes. However, daily hire rates have declined by 40% since 1 January to around USD 7,000 per day and are now trading close to estimated OPEX levels.

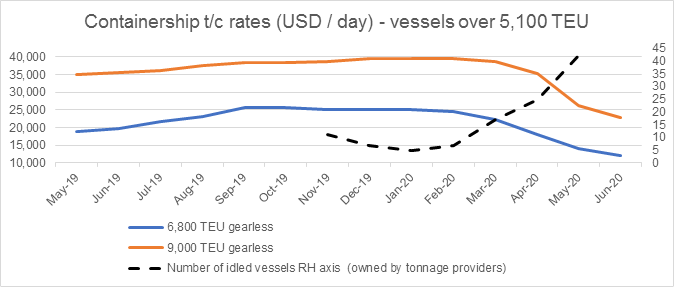

The recent collapse of daily hire rates in the vessel ranges above 5,100 TEU up to about 9,000 TEU has been even more dramatic. Daily hire rates for these vessels have halved since January 2020. As an example, the mv Northern Jamboree (8,411 TEU, built 2010) was fixed by MSC in early June for 11 to 13 months at a daily rate of USD 12,500. Vessels of this size were being chartered for around USD 25,000 in February 2020. These vessels have suffered the most as liner operators have re-deployed their own tonnage as a priority, with the return of excess chartered-in units seen as a key means of cutting network costs.

A key point here is that tonnage providers own a relatively smaller segment of the global container fleet over 5,100 TEU. However, many tonnage providers have vessels of this size out on long-term charters at rates agreed before the current crisis, but any units that are due for re-delivery in the next six to nine months (and there are some), will find themselves possibly securing future employment at perhaps half the rate levels (or even less) of before.

Key credit concerns

Tonnage providers are not yet selling ships for scrap, but the charter market is trending towards the barren years of 2012-2017 when banks became ship owners, and demolitions accelerated. For the moment, it could be argued that indebted tonnage providers which are heavily reliant on the feeder and niche trades for the short-term deployment of their assets are most at risk. Furthermore, any units which are idled for more than three months face expensive re-activation costs, and any that do not continue to be well maintained will be avoided by charterers.

A passing observation concerns owners which spent heavily on new scrubber technology at up to USD 3m per vessel. With the current spread between IFO 380 non-compliant and low-sulphur fuels of around USD 50 per tonne, estimated pay-back time could be doubled or tripled. These vessels are not apparently earning any premium, when in January 2020, owners were talking of a genuine two-tier market.

The ability of independent containership tonnage providers to weather storms has historically been challenging to assess. The 2012-2017 period was marked by the failure of multiple participants in the KG financing market, where counterparty risk came down to the willingness of individual investors in each fund to support (or refinance) the asset. Since that time there has been a flow of assets from these defunct funds into consolidators, including dedicated containership specialists such as Global Ship Lease, Inc., or MPC Containerships ASA, or forming significant parts of wider portfolios managed by the likes of such as Borealis Finance LLC, Celsius Shipping ApS, Tufton Oceanic and Lomar Corporation Ltd. While some of these file quarterly accounts, others are privately held, and comprise complex corporate structures, opaque income streams and unknown obligations to investors. These structures may face greater demands for transparency during these difficult times.