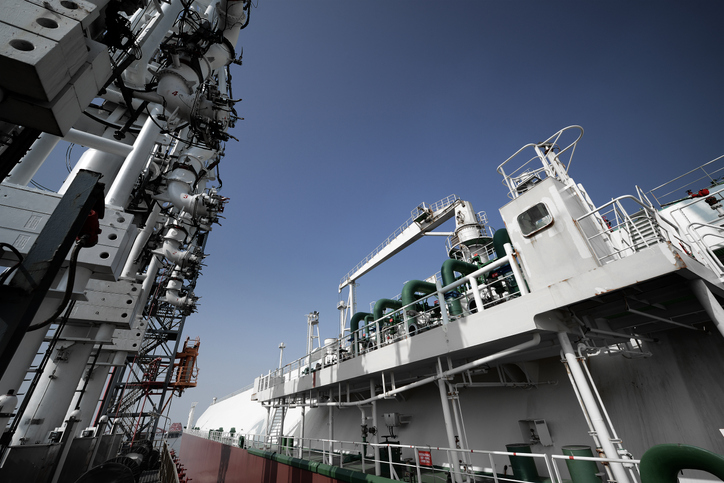

The emergence of the United States (US) as a net exporter of LNG in 2016 upended the supply-demand balance in the sector, enabling importers to accelerate a transition away from fuels perceived to be more polluting, and the LNG shipping sector to adopt a more spot-driven model, underpinned by speculative orders for LNG tonnage. In 2019, final investment decisions were taken to proceed with a reported 71m tonnes of new production capacity, much of this capacity also uncontracted, with further liquefaction projects, with a capacity of circa 900m tonnes per year, on the table by the beginning of 2020.

LNG - Navigating Politics and Pandemic

Topics: Insights

False Positives - Not at all Positive

The use of sanctions by the US Government, particularly under the current administration, has proved an immense compliance headache for our sector, with shipping, commodity trading, banking and insurance sectors all having to react quickly to initiatives put in place with little warning. While some industry participants proved somewhat adept at “working around” such issues, the increased surveillance of sanctioned and non-compliant activities, particularly over the last 12 months, has reignited a focus on compliance.

Topics: Insights

Tonnage provider risks in the container sector

A return to the bad old days beckons for container tonnage providers. With container volumes dropping like a stone since February 2020, demand for chartered tonnage has also fallen away – tonnage providers are looking at a bleak near-term future with no immediate kickers to push earnings back up.

Topics: Insights

A Post-Covid Future?

We are probably all considering the reality of our lockdown lives now that the novelty has worn off and, for those of us in COVID hot spots like the UK, we face up to ‘the new normal’, whatever that may be.

Topics: Insights

KYC and the Documentary Arms Race

Back in the golden days of working from offices, there was apparently a thing known as “my word is my bond”.

Topics: Insights

WTI futures market: Risk versus Return in an Unprecedented Era

The rollercoaster that is today’s West Texas Intermediate (WTI) futures market promises to give everyone connected to oil derivatives trading a very interesting ride in the weeks and months ahead.

Topics: Insights

Hin Leong - A lesson learnt?

Yet again, we, as risk analysts, have to pick apart a major corporate failure and see what could have been done differently. How can lessons be learned, and models adjusted, in the future?

Topics: Insights

Due diligence and fraud, a case study

Being a risk manager nowadays requires an enormous range of skills and knowledge, covering compliance, pricing, credit, operational and market risk, geopolitics, sanctions, and deep commercial awareness. Throw in the unfolding impact of the Covid-19 pandemic (not least on the availability of sources), and it’s hardly surprising that in the fast-paced world of shipping and commodities, the importance of basic “vanilla” due diligence is sidelined.

Topics: Insights

Oil market shock: Transition will give way to Adaptation

With a sharp downturn in prices and unclear future demand, the oil industry is facing major challenges in the wake of COVID-19. How will it adjust? What changes will we see? And, what are the implications for risk analysts across the industry?

Topics: Insights

Containers and COVID-19 - Supply/Demand on a knife edge

Container rate fundamentals have remained solid so far, but future western demand and its supply chain handling ability is a serious concern.

Topics: Insights

.jpg)