Initiated by the pandemic, pressure on the current global supply chain is likely to continue for the near to-mid-term, providing opportunities and risks for liner operators, and challenges for cargo owners

The COVID-19 pandemic has not only exacerbated long-standing shortfalls in the global supply chain, but it has also created new pressure points, including crew quarantines, local port shutdowns, and labour shortages. During the spring and summer of 2020, while ports mostly remained open to support continuing supply of essential goods, non-essential trades were actively deferred. At the time, given the uncertainty of the pandemic’s impact upon economic demand, as of March 2020, container sector analysts were forecasting a global decline in containerised cargo volumes of about 10% year-on-year for the full year. It was in this context that, by July 2020, as initial lockdowns were lifted, circa 9% of the global container fleet capacity (in excess of 300 vessels) had been idled. As pent-up demand drove global growth, there was a rapid readjustment of liner capacity as vessels quickly rejoined their former trade routes.

To deal with the economic fallout, governments across the globe embarked on fiscal stimulus programmes that fuelled a resurgence in demand for commodities and consumer goods. Instead of the originally forecasted global decline, containerised cargo volumes decreased by just over 1% in 2020 compared to the year earlier. Despite the continued growth of the container fleet, the lack of demolition activity and the current size of the orderbook, the demand momentum has continued throughout 2021 and is estimated to surpass pre-pandemic levels. Year-on-year growth in containerised cargo volumes for 2021 is forecasted to be around 6%, which equates to 5% growth when compared to 2019 levels. Changes in consumption patterns during the pandemic have led to a significant growth in e-commerce. In the United States, headhaul transpacific year-on-year containerised cargo volumes are expected to be up by around 28% (or an additional 3m TEU) for 2021.

Port congestion and logistical challenges have reduced effective liner capacity driving the current supply chain pressure

Despite the previously idled services re-commencing under the major liner alliances, the upgrading of services with larger tonnage, the temporary movement of larger vessels from other trade lanes, the many “extra-loaders” deployed by some operators, and the new entrants to some routes (particularly the transpacific), ships have continued to sail at 100% utilisation, with cargo often left on the quay. The driver of this has been general port congestion, which according to industry research in August 2021, was estimated to have removed about 12.5% of global operational capacity due to inefficiency and general delays.

Over the last 12 months, scrutiny shows that the supply chain issues associated with port congestion are predominantly linked to the United Sates. The fact that the average size of vessels calling at the San Pedro Bay ports of Los Angeles and Long Beach (LA/LB) has considerably increased in the last decade to over 8,000 TEU capacity (and for some services up to 14,000 TEU capacity), means that total exchanges of containers per port call have also increased considerably. With limited terminal capacity expansion in the United Sates, this has led to clear pressures at the port to handle ever-increasing volumes of cargo (including quay storage).

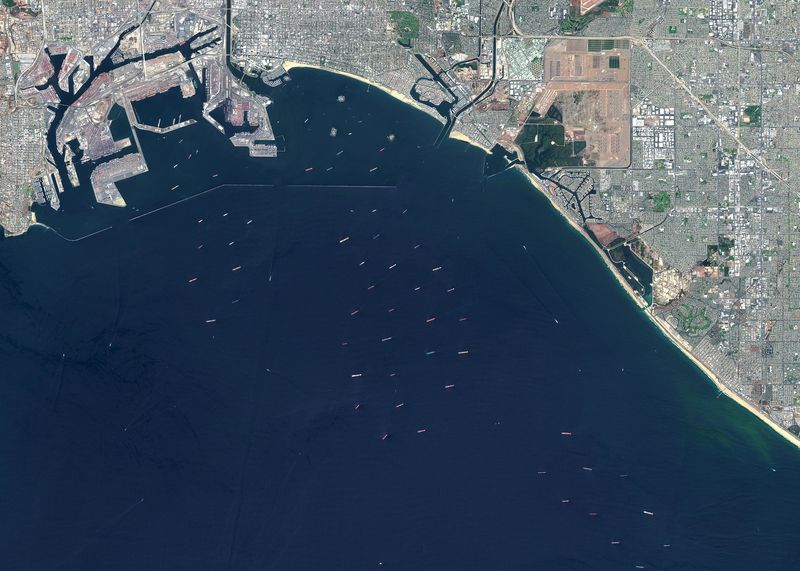

The Evergreen-operated containership mv Ever Given physically blocked passage through the Suez Canal for six days in late March 2021, adding further congestion to an already global problem. Dozens of vessels bound for North European and Mediterranean ports were delayed for weeks, and 17 Asia-Europe and Asia to US East Coast services were diverted around the Cape of Good Hope. Nevertheless, having worked through these unexpected supply shocks, currently, berthing delays at major container ports such as Busan, Shanghai and Ningbo are between two and three days (although these have improved from an average of four to five days earlier in June/July 2021). Mostly however, the congestion on the western seaboard of the United Sates has been acute, resulting in overall delays to individual round trip voyages, and the cancellation of port calls. In early December 2021, there were about 40 containerships at anchor off LA/LB waiting for a berth, ranging from about 1,700 TEU to 14,000 TEU capacity. Depending on the individual operator and whether or not defined berth agreements were made with terminal operators, individual vessels may have been at anchor for up to 60 days, with an average of nearly 20 days. Due to changes in queueing systems in November 2021, an additional 56 ships were waiting up to 150 miles offshore. It should be noted that while some ports technically operate 24/7 (as in most Asian ports), and gates have been extended in LA/LB since the summer, market feedback suggests that the operating reality is very different and few improvements have been noted.

Congestion at Los Angeles and Long Beach ports (Photographer: Gallo Images Editorial/Getty Images)

Congestion at Los Angeles and Long Beach ports (Photographer: Gallo Images Editorial/Getty Images)

About 40% of import containers to LA/LB move inland to the Midwestern and Eastern states, and the nationwide chassis and railcar shortages have delayed the movement of cargo off the quay, and equally critically, disrupted empty equipment being returned for backhaul restitution to areas of demand in Asia. As a result of the pandemic, truck drivers have left the sector, resulting in a shortage. Moreover, certain pockets of sustained demand, such as in the foodstuffs segment, has exposed deficiencies in specialist refrigerated equipment. As vessels spent more time in port and congestion started to become more prevalent, the length of time taken for empty equipment to return to Asia increased; some vessels “cut and run” from individual ports and had no time to physically load empty equipment, and containers were often delayed inland.

How has the market reacted to or adapted to the supply chain problems?

- Some shippers have turned to the multipurpose (MPP) sector to charter space (in some cases chartering entire vessels), with others endeavouring to charter space from operators of Handysize tonnage (usually catering for dry bulk or non-containerised cargoes). Shippers include some of the largest US and European retailers, such as Home Depot, Dollar Tree, Walmart, and Ikea.

- Attracted by the record freight rates on the East-West headhaul trades, opportunistic companies have entered the Asia to Europe and transpacific trade lanes, offering new services to shippers. Such operators include China United Lines Ltd and BAL Container Line Co., Ltd. Several freight forwarding companies have also chartered-in entire vessels from existing liner operators. It is notable in these cases, that new entrants have chartered vessels from owners for short periods at record high rates.

- Starting more services on the Asia to Southern California route, without adequate measures for easing port congestion, leads to increased wait times, leaving the underlying supply side constraints unaddressed. Freight rates have increased week-on-week throughout 2021, which although positive for the liner operators’ profitability, had placed considerable added pressure on cargo-owners. Moreover, the introduction of costly surcharges by liner operators to guarantee shipment on an individual sailing has caused much ire with shippers. For their part, liner operators have had to constantly review their global networks since the beginning of the pandemic, with indications that, for example, 380 individual European port calls have been skipped from regular liner services (in efforts to maintain schedules) on the Asia to Europe trade over the last five months.

- Traditional maritime liner companies are now radically changing. Several of the largest liner operators, including Maersk and CMA CGM, are now focusing more than ever on becoming end-to-end logistics operators, and have acquired several land-based companies to boost their capabilities.

- As part of the solution to address perceived capacity shortfalls, during 2021, all major liner operators have placed significant orders for vessels, ranging from 1,100 TEU feeder size, up to 24,000 TEU ultra large container vessels, to be deployed on the Asia to Europe route. Year-to-date, orders have been placed for over 400 units (with a total operating capacity of 3.75m TEU) and at an estimated total cost of about USD 32.5bn. With the newbuilds expected to be deployed in 2023/2024, the resulting debt/capex exposures of some owners will require close monitoring, especially when the cycle moves towards its inevitable correction.

- Clear pressure has been placed on the Biden administration to actively review possible solutions to the supply chain issues in the United States. The positive impact of the USD 1trn infrastructure bill, which includes a USD 17bn investment in infrastructure improvements at coastal ports and waterways, is likely to be felt only in the mid to long-term.

Although dry bulk vessel operations have also been impacted at key ports during the pandemic, the port congestion and capacity constraints in the container sector in the face of sustained demand has led to exceptional growth in freight rates. This has, for the most part, strengthened the financial position of liner operators/owners, with further effects (mainly positive) reaching other sectors, notably MPP and dry bulk. The solutions to the supply chain problems are not readily apparent or implementable, and improvements envisaged by the US’ infrastructure bill are likely to take years to have the desired effects. The recent emergence of the Omicron variant highlights the uncertainty surrounding the COVID-19 pandemic’s evolution, governments’ reactions to it, and the wider implications on demand that underpin the sector’s current strength. Risks and volatility remain evident, and if historical cyclicality is anything to go by, it would be prudent to monitor the financial discipline exercised by the liner operators during this time of exceptionally high freight rates. In the meantime, the implications for cargo owners are obvious – make a plan B, and expect higher costs.

Click here to find out more about Infospectrum's services