Driven by an unexpected surge in demand and record profitability in the last 12 months, owners have returned to the newbuilding market to capitalise on the global requirements for additional capacity.

While war chests have evidently been sufficiently strengthened to prompt a sharp increase in tonnage acquisitions and newbuilding orders, it would be wrong to dismiss the prospect of any future risks down the line for investors.

The container market is ‘white-hot’ at the moment, which is heavily ironic given concerns expressed by some during the onset of the COVID-19 pandemic. When global demand for consumer goods kicked back into gear from July 2020, containerised spot market freight rates started creeping upwards, and since the end of last year, they have consistently surpassed previous records on all major global liner trade lanes. Driven by this hugely positive uptick in 4Q 2020, all major global and smaller regional liner operators booked strong net profits in 2020, with independent tonnage providers massively benefitting from improved daily charter hire rates. For the top nine liner operators (excluding MSC), combined net results totalled just under USD 12bn. An interesting development for a sector whose operators have characteristically prioritised market share over profitability.

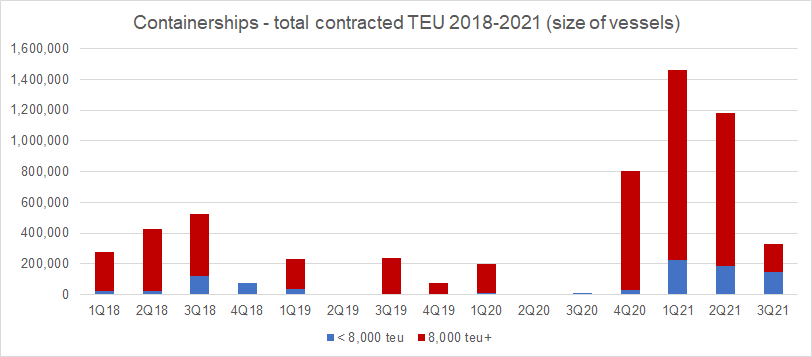

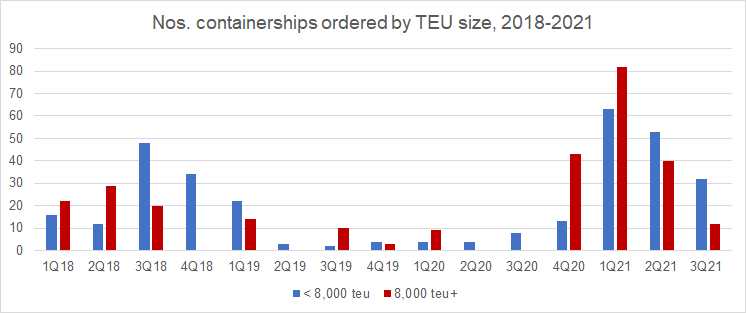

Liner operators have historically been creatures of habit, and usually start talking to shipyards to place new orders once they return to profitability. The two tables below follow this well-beaten path, with relatively few orders placed in 2019 (a poor year for operators), and little activity between January and November 2020, corresponding with the initial negative impact of the pandemic, and the clear desire to rein in capital expenditure.

Sources: Clarksons, various industry sources

Source: Clarksons, various industry sources

However, the container sector was less affected by the pandemic than others, since global demand for consumer goods (led by US households) came back with a vengeance after the initial national lockdowns. This, together with growing supply chain issues, lack of empty containers, and port congestion, led to a severe lack of capacity in major trade lanes. Vessel asset prices have in some cases doubled since mid-2020, and daily time charter rates for all containership sizes significantly increased by the close of 2020. This has seen many shipowners commission newbuildings to increase their market capacity to supplement what they could also acquire in the second-hand market to meet demand. While latter forays into the second-hand markets, particularly from MSC and Wan Hai have been significant, this is relatively small fry compared to the newbuilding commitments made in the last 12 months. It is very clear that improved, and in some cases record profits, have driven owners to commit to sizeable commissioned orders.

Late 2020 saw a significant number of orders for ULCVs of 24,000 TEU placed by Ocean Network Express and MSC, with the turn of the year in 2021 seeing the market literally move into overdrive, at a pace not seen since 2006/2007. Gorging on their profits from the elevated freight markets, Evergreen, MSC, Wan Hai, CMA CGM, HMM, Hapag-Lloyd and, most recently, COSCO have each placed a series of orders with major Chinese and South Korean shipyards for vessels ranging in size from 3,000 TEU to 23,500 TEU. Haifa-based Zim, has also come back to the market after many years to commit to multi-year charters of a total of 20 7,000 TEU and 15,000 TEU newibuilding boxships, long-term leased from Canada-based tonnage provider Seaspan. The latter company has been on an immense ordering spree since December 2020, with 55 containerships booked with major shipyards; All the Seaspan new orders are understood to be backed by long-term charters to a number of liner operators in addition to Zim.

The need for additional capacity has meant that new players or old stalwarts have returned to the market with speculative plays for smaller tonnage of below 4,000 TEU; these include Briese Schiffahrts, Vega Reederei, Tsakos Shipping & Trading, and Capital Maritime & Trading, as well as newer and small Chinese liner operators (such as China United Lines) eager to enter the larger global liner trade routes.

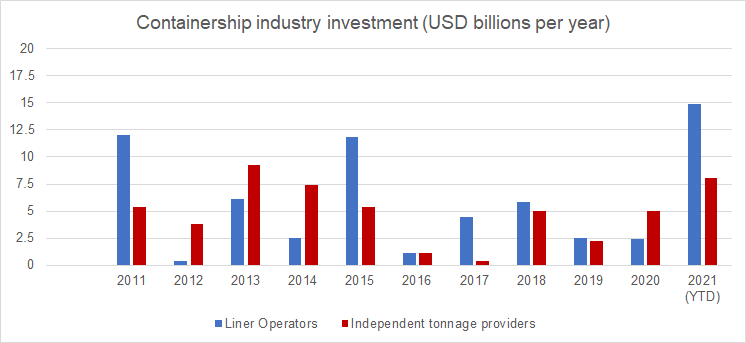

Reported 1Q 2021 net profits for many liner operators have reached never-seen-before levels, fueling the orderbook fire. Collective net profits for eight of the leading liner operators have reached about USD 10.5bn for this period. Furthermore, AP Moller-Maersk separately disclosed the EBIT of its “Ocean” division (effectively Maersk) which totalled USD 2.7bn. The industry’s number two liner operator, MSC, provides no financial visibility for public disclosure. Relatively few liner operators have provided financial results for 2Q 2021, however, the recent positive trend continues, with Maersk booking EBIT of USD 3.6bn, and HMM, Ocean Network Express and Hapag-Lloyd, racking up additional total net profit figures of USD 4.6bn between them.

While order prices are not always disclosed, based on publicly disclosed information and third-party data newbuilding containership orders had an estimated combined total value in the region of USD 7.5bn in 2020 (with around USD 6.2bn reflecting orders placed in 4Q 2020), and about USD 23bn year-to-date (mid-August) in 2021. Liner operators have committed about USD 14.9bn of the 2021 total on a direct basis, with the rest from independent tonnage providers. The current year has seen more orders placed than at any time since the global recession of 2008. To put this activity into perspective, the previous record year (2011) saw total industry investment of about USD 17.4bn. Maersk appears to be somewhat of an exception in that, to date, it has focused on small tonnage with specialised fuel requirements. However, we understand from industry sources that the company is currently talking to shipyards about the possibility of placing a sizeable order for larger tonnage.

Sources: Clarksons, various industry sources

The new and rapidly changing regulatory framework around fuel emissions control is also a factor that cannot be ignored in the current newbuilding race. However, in developing their tonnage capacity, liner executives appear to be focusing on scrubber technologies and essentially have the main eye on increasing capacity to take advantage of the market.

The newbuilding order boom has clear ramifications for the container sector, some positive and some less so, presenting potential risks.

Positive

- Proof that the container sector is in strong shape

- Liner operators are endeavouring to meet near/mid-term and future capacity requirements of the market

- A substantial boost for the shipbuilding sector

- New entrants and established ship owners who have been reticent to move into containerships are making a new entry to the sector

- Re-investment in the sub-4,000 TEU vessel sizes that has been lacking for years

- Re-ignited investor confidence lays the path for an added source of capital for the sector

Negative (or potential risks)

- Investment in significant numbers of new vessels at a time where uncertainty around new and rapidly changing regulatory requirements on fuel emissions could later result in unexpected retrofitting requirements, or even curtailment of originally anticipated operating life

- Will the global markets still be able to comfortably absorb this level of new tonnage in 2023/2024 when the vessels are delivered? The jury is out concerning future levels of demand

- Are the current widespread and significant supply chain challenges temporarily masking the genuine requirement for new capacity?

- When the freight markets find a new equilibrium, revenue and profitability may not be enough to finance the record levels of debt

- Liner operators continue to grow their fleet sizes, increasing their individual exposures to the bunker market, where prices have been following an upward trajectory.

- What will the operating economics of vessels be in 2023/2024 when they are delivered?

- The newbuilding market does not operate in isolation. Liner operators are all exposed to increasing charter rates and bunker costs

- Speculative tonnage ordered by independent tonnage providers will always carry inherent risk based on future unknown charter market dynamics and hire rates

- Increased ordering by major liner operators for small tonnage of below 4,000 TEU could lead to a reduced requirement for such tonnage from independent tonnage providers

It would be wrong to dismiss any future risks down the line for investors since firstly, the consensus industry view is that the current positive market dynamics (for owners) will likely last for the near-to-mid term at least, and liner operators should be able to continue to grow their war chests. However, liner shipping will always be cyclical and when the bubble bursts, the congestion and capacity issues which have plagued (but equally driven the industry all year), will dissipate.

Then, the re-balancing to a “new normality” will come, and the need for renewed risk assessment will be required. At that time, the owner who placed orders at the height of the market, may well not be able to fix ships at the record levels of today. In 2023/2024, when the newbuildings recently/still being ordered are delivered, liner operators are likely to utilise void sailings/idling of vessels as their core weapon to manage capacity at the supply/demand level should cargo flows reduce or normalise. This will mean a much-reduced requirement from the liquid charter market. And if the last ordering boom of 2007/2008 taught maritime executives anything, it created years of overcapacity and cascade/deployment issues. A recurrence not beyond the realms of possibility. Finally, there is the repayment of debt, and owners would be wise to use these good times to pay down as much debt as possible.

Infospectrum has the largest Databank of shipping and commodities risk appraisal reports in the industry. View our latest reports by clicking the link below: