Liner spot freight rates have recently defied traditional and current logic, reaching record levels. In early-March 2020 most freight analysts predicted Armageddon for the liner sector with cargo volumes falling off the proverbial cliff. What has since transpired?

Liner operators have historically been poor freight rate negotiators. During weak market cycles evidenced by slow cargo volumes, they have persistently fought for market share and invariably driven spot market rates down week-on-week.

In an unprecedented situation since February 2020, which has seen the COVID-19 pandemic have such a marked negative impact on global container volumes, most analysts forecasted huge losses for the liner sector this year.

This would have spelt potential disaster for individual companies which would ultimately have deeply affected the stability of the container supply chain. But, the last six months have seen traditional thinking turned on its head and has shown the container sector to not only be suprisingly resilient, but seemingly intent on changing its core strategy, perhaps forever. Market share and volume is no longer king, the end game is now about companies seeking compensatory freight rates and profitability.

Well targeted capacity withdrawal

Comparisons are made to the last major market downturn in 2009/2010, but this time round, the reaction from the liner operators has been different. All players have quickly withdrawn sizeable capacity on major headhaul trade lanes since late February 2020, either through missed sailings or the suspension of entire services. This has continued to be ruthless.

The global capacity management has been extremely effective in balancing supply and demand at the trade route level, and in some cases more recently due to a resurgence of consumer spending, has led to pockets of undersupply. All of this has clearly focused the minds of carrier executives – and as a result, spot market freight rates have not only remained robust, but on some routes, they have rocketed to record levels.

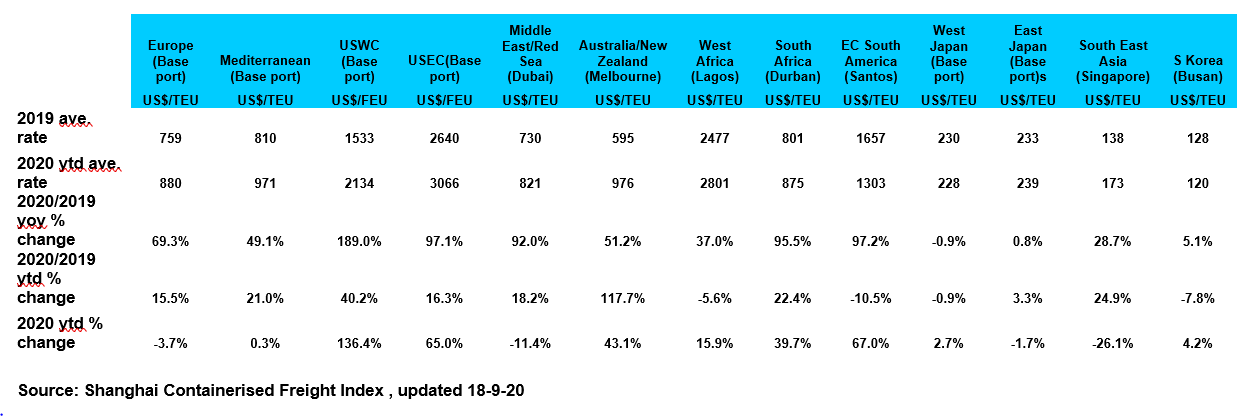

The table below shows the results of this capacity management. However, these record transpacific rates have upset shippers so much that the Chinese authorities have intervened in an attempt to stabilise foreign trade. The US Federal Maritime Commission has also warned ocean carriers that it will deal severely with ocean carriers if any evidence of collusion on pricing is found. The core East-West headhaul routes from Asia to Europe and North America are where the lines deploy their largest and most expensive vessel assets, and where margin gains are usually won or lost.”

For example, average spot freight rates from Shanghai to US West Coast ports have reached around USD 3,850 per FEU in mid-September (about 40% up year-on-year when compared to the 1 January to mid- September 2019 period). Similarly, rates from Shanghai to US East Coast ports have surged to USD 4,600 per FEU (about 16% up year-on-year for the same time period. The latter trade’s levels have not been seen such an uplift since 1Q 2015, when temporary dock strikes halted much port activity in the US. With the exception of the intra-Asian routes (which have always been the most competitive of all global lanes), carriers have enjoyed strong rates for most of 2020. This is of course counter-intuitive in the current market ravaged by COVID-19. With the added-bonus of significantly lower fuel costs for both non-compliant IFO 380 and VLSFO, ocean carriers have of course benefited.

Back to Black

Despite the decline in container volumes (which is estimated to have been about 8% year-on-year for the January to May 2020 period), and the associated decline in overall revenues, virtually all major shipping lines have reported bottom-line profits at the halfway stage in 2020. Perennial loss-makers Zim and HMM booked 2Q 2020 net profits of USD 25.3m and USD 23m respectively. German operator Hapag-Lloyd showed a 2Q 2020 net profit of USD 288m, proving to be one of the sector’s top and most consistent performers in the last two years.

Despite the furore from shippers over the strong freight rate market, the figures below scream one point that stakeholders are missing. The intra-Asian trades, which are also the largest with respect to total volumes in the global container market, have not shown a similar rate surge. In this respect, regional players remain in a hugely challenging market, as do intra-European feeder operators who have suffered from the lower volumes exported from Asia on headhaul routes since March 2020.

Adversity to Prosperity

With the container world seemingly topsy-turvy, what does the near-term future look like? Well firstly, none of us (including the shippers) should be disappointed here, as a strong liner sector is an added-bonus during the COVID-19 era, and is one less sector for bunker and other marine consumables suppliers to lose sleep over. Indeed, our feedback from suppliers in the last six months is that payments from the majority of ocean carriers remains consistently positive. Our view is that some of the steam from these red-hot trades is likely to come off as we move into the final quarter, which is usually the weakest of the year. Despite this, the major line operators are forecasting a strong year and that they will remain in the black. Very few people, if anyone, predicted that six months ago.

While independent tonnage providers were suffering from the ill-effects of an idle container fleet, which at its height in late-May 2020 reached 11.6% of the global container fleet, increased demand has boosted daily time charter rates, and given them comfort that they will remain in the black this year. History also tells us that in virtually every previous upturn in the container market, companies have gone back to the newbuilding market to place orders for new vessels. COSCO, Hapag-Lloyd and ONE are known to have shelved plans for extensive new orders. If these are reactivated in the next six months, it could mark another new era in the constantly evolving liner story.