This week's Insight has come from Infospectrum alumnus Ian Staples, now a Global VP at Inchcape Shipping Services, who has been keeping an eye on movements in the VLCC sector.

Those in the know will be able to tell you that the crown of being the world’s largest crude oil producer has changed hands recently. In 2017, it definitively became the property of the United States (US), which has overtaken Saudi Arabia and Russia to make Donald Trump the biggest noise in the crude market. More significantly, the US has become a significant exporter of crude since its 40-year ban on exporting was lifted in December 2015. The majority of this growth is coming from the ramping up of giant shale projects such as SCOOP/STACK, Permian and others. A rush of projects to fix internal bottlenecks are underway, designed to get this oil into ships.

Oil exports from the US are shipped through the Gulf, quickly establishing short trading routes to Canada and Northern Europe. A significant percentage of these exports are currently Asia-bound, but cost competition limits this trade significantly. Anybody familiar with loading ships in the US Gulf will quickly tell you that the burden for exporters is the shallow draft predominant in all ports bar Louisiana Offshore Oil Port (LOOP), which has the capacity to load VLCCs, but was originally built as an import facility. Consequently, the vast majority of trades from the US Gulf is (at least initially) loaded on Panamax, Aframax and occasionally Suezmax vessels.

There is trade in VLCC exports, but other than via LOOP, it is based on what is known as ‘reverse lightering’ or, as anybody familiar with the dry bulk market might say, transshipment. This is done almost exclusively through the shuttling of Aframaxes to VLCCs in four areas that are available for this type of ship-to-ship transfer. This loading via transshipment comes at a cost. Aframaxes performing the shuttle service have recently been fixed at USD 50,000 per day. Four Aframaxes to load a VLCC, the cost of the VLCC at anchorage while loading, four ice creams and some chocolates for the office, and before you know it you have spent north of USD 1m on freight on a USD 9m trade. Ouch!

Preparing for the surge

To combat this reverse lightering cost, which is still a growing trade by the way, LOOP has been in full swing. It loaded nine VLCCs in 2018, but completed three in December 2018 alone. LOOP statements indicate that it can load a VLCC in two days now, but only predicts one per month in 2019, most likely constrained by supply of oil, not demand from buyers. With potential growth of more than a million barrels per day (MBB/D) every year for the next five years though, it is apparent to all that the current infrastructure to support this level of export growth is nowhere near in place. Shallow waters, transshipment, all these things end up costing money and holding back trade. If growth projections hold true, US exports will reach 6.5 MBB/D by 2024, with the current record month average being 2.3 MBB/D (seen in October 2018). This will quickly create an annual infrastructure deficit prohibiting these targets being achieved. There is an urgent requirement for many more loading facilities with deep water capacity that can load VLCCs. And there are plans for lots of these.

At present there are as many as eight facilities that are in planning up to final funding mode. These include major projects along the Gulf coast from Brownsville to Tall Grass, Louisiana. If all of these proposed projects gain funding and get into production, then there will be enough deep water VLCC capacity to cover US crude export growth for at least a decade or more, so we would not expect more than two or three to get off the ground. However, a significant amount of capacity will be added and this will be a game changer for global oil trade and shipping to boot.

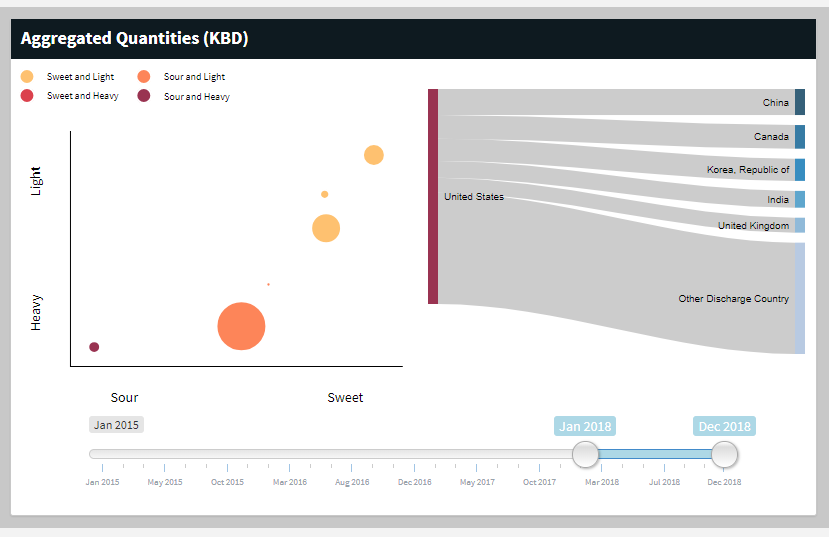

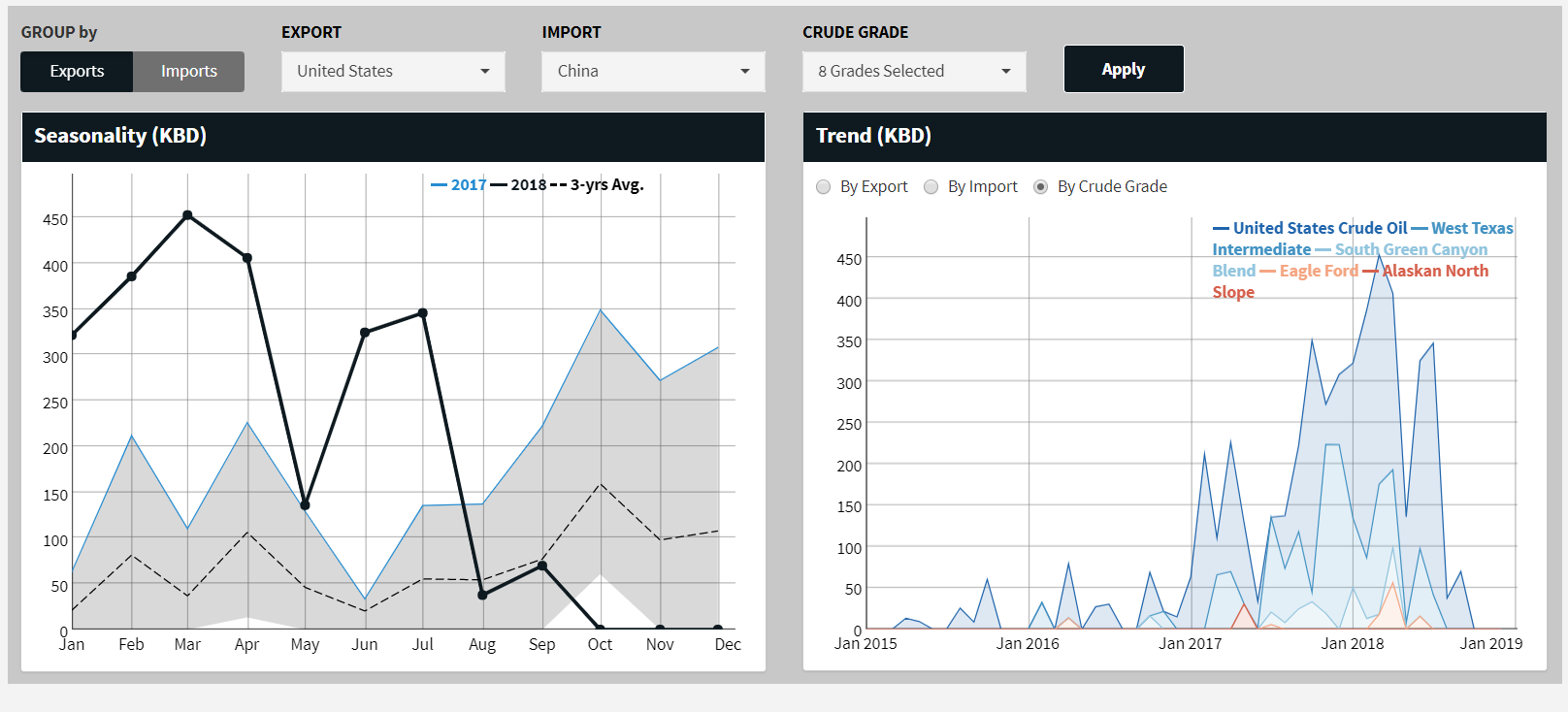

Source: OilX

What this means in effect is that the largest oil producer in the world will be consistently price competitive over long haul trades. And the largest importer of crude in the world is exactly the long haul trade that US crude exporters can now target, namely China. Imagine the impact of China becoming the largest customer for US crude exporters! The prospects are so fabulously complex economically, geopolitically and financially that it is better to leave everyone to their own thoughts on how that might play out. But I have to correct myself here, as the word ‘might’ is not correct. This will happen, it is happening and will have a dramatic impact on global tanker trades.

The impact on tanker trades

Before we get ahead of ourselves, as all sensible shipping people do, let’s deal with the negatives for the tanker market. OPEC+ is committed to production cuts of more than 1 MBB/D (estimated as 0.8 MBB/D by OPEC, 0.4 MBB/D by their ‘partners’). This has brought the professional shipping mourners to the front of the procession to cry and tremble at the prospect of tanker freight rates going to zero overnight. However, a quick reality check says that global oil production currently sits at 80.6 MBB/D, so this 1.2 MBB/D represents less than 1.5%. Secondly, the order book for 2019 shows an upturn in deliveries, with VLCC net fleet growth likely to be 12-14%. For those of you familiar with the work of Private Fraser – we’re all doomed! But again, this comes on the back of VLCC fleet growth of less than 1% in 2018. So, bearing in mind all the usual caveats about new building deliveries and scrapping, there’s not too much to see here either.

With US export growth of around 1.2 MBB/D (if you round up 1.16 MBB/D, or just accept the possibility of a small error in the forecast), doesn’t that pretty much offset the OPEC production cuts? One of the favourite tangles that analysts like to get themselves into is that of tonne-miles. Needless to say that when you don’t really know the tonnes, and you multiply that by miles between two guessed points on the globe, you get a multiple of ‘guessed wrongness’, which is a fabulous description of pretty much any shipping forecast. However, what any child with a globe in her bedroom will be able to tell you, Houston is further by sea to China than Saudi Arabia. So tonne-miles are going up, and by a lot.

Source: OilX

Data from OilX to look at USG/China crude trade shows us two interesting phenomena. Firstly, the growth in trade, even with the limits to infrastructure that are currently in place; the trade is demonstrably growing as of today. Secondly, how this trade has shrunk to zero in recent months. Contrary to the possibility of this data totally undermining my whole argument, it is simply a reflection of the impact of the US/China trade war. What we think this implies is the significant build-up of demand for US crude in China, which will ultimately manifest itself when the trade wars wind to their inevitable pointlessly status quo-resuming conclusions. The temptation was to exclude this graph as an inconvenient truth behind a complex argument, but on closer review it simply adds to the debate that, behind the politics, the trade is growing and has huge capacity to grow quickly once VLCC loading becomes commonplace.

One of the most telling signs of a genuine shift in trade, or something new at least, is when foreign brokers start to appear. And they are appearing now. VLCC brokers’ passports are being stamped at George Bush International on a frequent basis. Jockeying for key contacts and competitive socialising on the golf courses of Southern Texas gathers pace. A new route USG/Asia is being traded for VLCCs, having been introduced by the Baltic Exchange, which has traditionally followed rather than led route and index changes, although to date trading is very light. There are even FFA brokers circling the region, who are quite possibly the very last people to jump on a passing gravy train. Make no mistake, this is real trade, but how real it becomes in boosting the market very much depends on how quickly the tanker owners of the world can start talking this one through the roof.